Knowing Your Debits From Your Credits

By John A. Tracy

Accountants and bookkeepers record transactions as

debits and credits while keeping the accounting equation constantly in balance. This process is

called double-entry bookkeeping. Double-entry bookkeeping records both sides of a transaction —

debits and credits — and the accounting equation remains in balance as transactions are recorded.

For example, if a transaction decreases cash $25,000, then the other side of the transaction

is a $25,000 increase in some other asset, or a $25,000 decrease in a liability, or a $25,000

increase in an expense (to cite three possibilities).

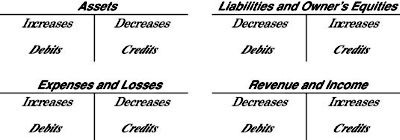

This illustration summarizes the basic rules for debits and credits. By long-standing

convention, debits are shown on the left and credits on the right. An increase in a liability,

owners' equity, revenue, and income account is recorded as a credit, so the increase side is

on the right. The recording of all transactions follows these rules for debits and credits.

Rules for debits and credits.

Practically everyone has trouble with the rules of debits and credits. The rules aren't

very intuitive. Learning the rules for debits and credits is a rite of passage for bookkeepers

and accountants. The only way to really understand the rules is to make accounting entries

— over and over again. After a while, using the rules becomes like tying your shoes — you do

it without even thinking about it.

Notice the horizontal and vertical lines under the

accounts in the illustration above. These lines form the letter "T." Although the actual

accounts maintained by a business don't necessarily look like T accounts, accounts usually

have one column for increases and another column for decreases. In other words, an account

has a debit column and a credit column. Also an account may have a running balance column to

continuously keep track of the account's balance.

This is an excerpt from:

Trying to get certified and become an accountant? Own a small business but need a little

help balancing your books? Don't worry! This hands-on guide provides the learning and vital

practice you need to master important accounting concepts and basics. Perfect as a companion

workbook for Accounting For Dummies - or any other accounting textbook - Accounting Workbook

For Dummies gives you a wealth of real-world examples, demonstration problems, and handy

exercises. With this helpful resource as your guide, you'll master balance sheets, income

statements, and budgets in no time!

• Record transactions, track costs, and manage accounts

• Open and close bookkeeping cycles

• Analyze business performance and profit

• Choose the right accounting method

• Master investment accounting fundamentals

• Understand manufacturing cost accounting

Click here for more information.

|